Brook Park Income Tax Rate . (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. Brook park income tax is levied at the rate of 2.0%. interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: The tax shall be measured by municipal taxable income. That translates to $1,000 in municipal incomes taxes for each $50,000 a. The us average is 4.6%. Income taxable to the city is listed below. receiving net profits within the city of brook park. — the most common rate regionally is 2%. The us average is 4.6%.

from www.formsbank.com

That translates to $1,000 in municipal incomes taxes for each $50,000 a. Brook park income tax is levied at the rate of 2.0%. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: receiving net profits within the city of brook park. The us average is 4.6%. Income taxable to the city is listed below. The tax shall be measured by municipal taxable income. interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. — the most common rate regionally is 2%.

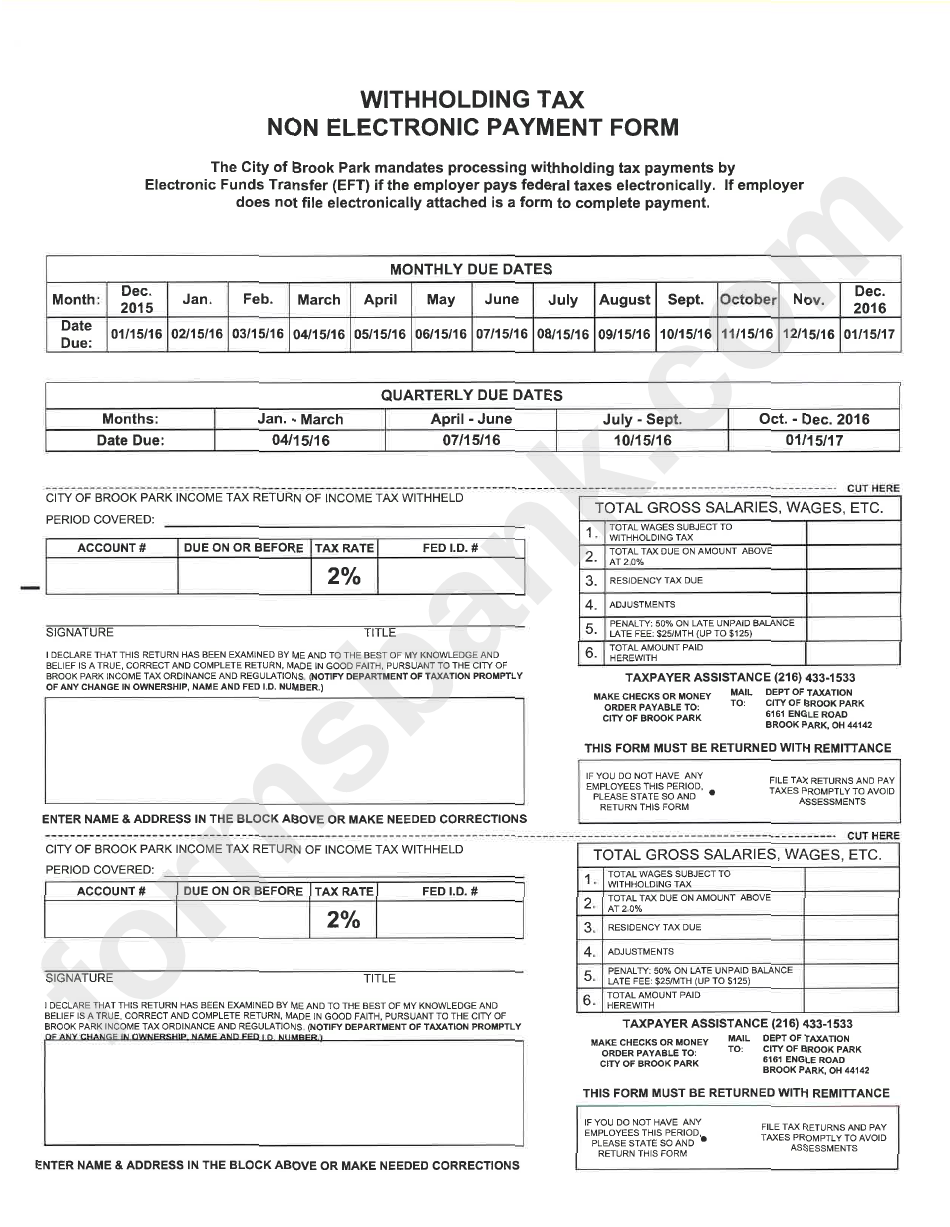

Withholding Tax Non Electronic Payment Form City Of Brook Park

Brook Park Income Tax Rate (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. The us average is 4.6%. interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: Brook park income tax is levied at the rate of 2.0%. The tax shall be measured by municipal taxable income. The us average is 4.6%. — the most common rate regionally is 2%. Income taxable to the city is listed below. That translates to $1,000 in municipal incomes taxes for each $50,000 a. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. receiving net profits within the city of brook park.

From www.neilsberg.com

Brook Park Township, Minnesota Median Household By Age 2023 Brook Park Income Tax Rate The tax shall be measured by municipal taxable income. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. — the most common rate regionally is 2%. receiving net profits within the city of brook park. interest shall be imposed on all. Brook Park Income Tax Rate.

From mungfali.com

Tax Rates Over Time Chart Brook Park Income Tax Rate The us average is 4.6%. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. The tax shall be measured by municipal taxable income. —. Brook Park Income Tax Rate.

From www.formsbank.com

Tax Form City Of Brook Park 2016 printable pdf download Brook Park Income Tax Rate interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. receiving net profits within the city of brook park. The us average is 4.6%. The us average is 4.6%. The tax shall be measured by municipal taxable income. (b) the tax is an annual tax levied on the income. Brook Park Income Tax Rate.

From www.formsbank.com

Reconciliation Of Tax Withheld Form Bw3 Instructions City Of Brook Park Income Tax Rate (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. — the most common rate regionally is 2%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. Income taxable to the city is listed below. receiving net profits within the. Brook Park Income Tax Rate.

From www.neilsberg.com

Brook Park, OH Median Household By Age 2024 Update Neilsberg Brook Park Income Tax Rate Income taxable to the city is listed below. receiving net profits within the city of brook park. — the most common rate regionally is 2%. Brook park income tax is levied at the rate of 2.0%. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: (b) the tax. Brook Park Income Tax Rate.

From www.formsbank.com

Estimated Taxpayment Form City Of Brook Park Department Of Taxation Brook Park Income Tax Rate Brook park income tax is levied at the rate of 2.0%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. The us average is 4.6%. — the most common rate regionally is 2%. Income taxable to the city is listed below. The tax shall be measured by municipal taxable income. interest shall be imposed on. Brook Park Income Tax Rate.

From bitcoinethereumnews.com

Here are the federal tax brackets for 2023 vs. 2022 Brook Park Income Tax Rate — the most common rate regionally is 2%. Brook park income tax is levied at the rate of 2.0%. The tax shall be measured by municipal taxable income. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. That translates to $1,000 in municipal. Brook Park Income Tax Rate.

From www.formsbank.com

Form Bpeftw1 Withholding Tax City Of Brook Park printable pdf download Brook Park Income Tax Rate (a) municipal taxable income for a resident of the city of brook park is calculated as follows: The tax shall be measured by municipal taxable income. The us average is 4.6%. The us average is 4.6%. — the most common rate regionally is 2%. interest shall be imposed on all unpaid income tax, unpaid estimated income tax. Brook Park Income Tax Rate.

From www.kare11.com

Minnesota 2023 tax brackets adjusted for inflation Brook Park Income Tax Rate (a) municipal taxable income for a resident of the city of brook park is calculated as follows: — the most common rate regionally is 2%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. receiving net profits within the city of brook park. (b) the tax is an annual tax levied on the. Brook Park Income Tax Rate.

From www.formsbank.com

Form D1 Declaration Of Estimated Brook Park Tax printable pdf Brook Park Income Tax Rate Income taxable to the city is listed below. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. Brook park income tax is levied at the rate of 2.0%. receiving net profits within the city of brook park. — the most common rate. Brook Park Income Tax Rate.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Brook Park Income Tax Rate (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. The us average is 4.6%. — the most common rate regionally is 2%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. The tax shall be measured by municipal taxable income.. Brook Park Income Tax Rate.

From www.mlive.com

Will Michigan lower its tax rates? Here’s how we compare to other Brook Park Income Tax Rate The us average is 4.6%. Brook park income tax is levied at the rate of 2.0%. (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. The us average is 4.6%. interest shall be imposed on all unpaid income tax, unpaid estimated income tax. Brook Park Income Tax Rate.

From www.cleveland.com

Brook Park voters will consider two tax measures on Aug. 5 Brook Park Income Tax Rate receiving net profits within the city of brook park. The tax shall be measured by municipal taxable income. The us average is 4.6%. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: (b) the tax is an annual tax levied on the income of every person residing, earning, or. Brook Park Income Tax Rate.

From www.pdffiller.com

Fillable Online Reconciliation of Tax Withheld Form Brook Brook Park Income Tax Rate (b) the tax is an annual tax levied on the income of every person residing, earning, or receiving income within the city of brook. Brook park income tax is levied at the rate of 2.0%. receiving net profits within the city of brook park. (a) municipal taxable income for a resident of the city of brook park. Brook Park Income Tax Rate.

From www.formsbank.com

Form Tax Return City Of Brook Park 2000 printable pdf download Brook Park Income Tax Rate The us average is 4.6%. The us average is 4.6%. The tax shall be measured by municipal taxable income. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: Brook park income tax is levied at the rate of 2.0%. (b) the tax is an annual tax levied on the income. Brook Park Income Tax Rate.

From exovinftw.blob.core.windows.net

Brook Park Ohio Taxes at Tim Carrier blog Brook Park Income Tax Rate — the most common rate regionally is 2%. The us average is 4.6%. The tax shall be measured by municipal taxable income. Brook park income tax is levied at the rate of 2.0%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. (a) municipal taxable income for a resident of the city of brook park. Brook Park Income Tax Rate.

From www.cleveland.com

Brook Park tax forms are online Brook Park Income Tax Rate interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. (a) municipal taxable income for a resident of the city of brook park is calculated as follows: Income taxable to the city is listed below. That translates to $1,000 in municipal incomes taxes for each $50,000 a. The us average. Brook Park Income Tax Rate.

From www.formsbank.com

Form Bw3 Reconciliation Of Tax Withheld City Of Brook Park Brook Park Income Tax Rate — the most common rate regionally is 2%. That translates to $1,000 in municipal incomes taxes for each $50,000 a. interest shall be imposed on all unpaid income tax, unpaid estimated income tax and unpaid employer withholding tax. Income taxable to the city is listed below. The tax shall be measured by municipal taxable income. (b) the. Brook Park Income Tax Rate.